Control your cover

Helping people like you with cover affordability

Your life insurance represents our promise to be there for you when it matters most, so it’s important you understand the ins and outs of your cover, and how to alter it, to keep up with your life changes too.

One of our jobs as an insurer is to ensure that the premiums collected are of a level to ensure claims can be paid. This means that we continue to monitor pricing and claims experience, across all products. Occasionally, we have to reprice our products to reflect changes in the cost of providing cover, so that we can keep you covered long term and maximise our ability to pay claims. Paying claims remains our unwavering priority and means our premium rates must reflect our true cost of providing protection.

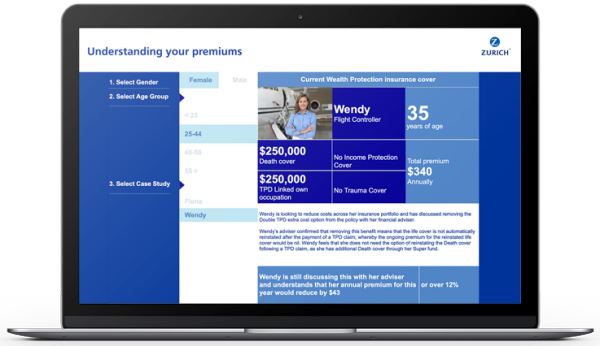

Explore how you can reduce the cost of life insurance and make it more affordable.

View your policy online

Check your policy details and see what you're covered for.

Keeping you protected

If you’re concerned about your premium, please talk to your financial adviser. They can work with you to see if it makes sense for you to adjust your cover.

Additionally, you can contact us. While we can’t talk to you about your personal circumstances in the same way your adviser can, we can talk to you about your policy, and the options available under your policy.

Need help finding an adviser?

Zurich provides a free service that can connect you to an independent financial adviser:

ASIC’s MoneySmart website also has valuable information on what to look for when choosing a financial adviser.

Or contact us

Call 131 551

Monday-Thursday: 8.30am – 7.00pm

Friday: 8.30am – 5.30pm

Email: client.service@zurich.com.au